Some Known Questions About Transaction Advisory Services.

Table of ContentsThe Ultimate Guide To Transaction Advisory ServicesThe 4-Minute Rule for Transaction Advisory ServicesTransaction Advisory Services - QuestionsTransaction Advisory Services Can Be Fun For AnyoneSome Known Details About Transaction Advisory Services

This action makes sure the organization looks its best to potential customers. Getting the company's worth right is essential for an effective sale.Deal consultants action in to assist by getting all the required info arranged, responding to inquiries from customers, and arranging check outs to the organization's area. This constructs trust fund with buyers and keeps the sale moving along. Getting the best terms is essential. Transaction consultants use their competence to assist entrepreneur handle difficult arrangements, fulfill customer assumptions, and structure offers that match the proprietor's objectives.

Satisfying lawful regulations is critical in any company sale. Purchase advising services collaborate with lawful professionals to produce and assess agreements, contracts, and various other lawful documents. This lowers threats and ensures the sale adheres to the law. The function of deal experts expands past the sale. They assist company proprietors in planning for their following actions, whether it's retired life, beginning a new endeavor, or handling their newfound riches.

Transaction consultants bring a wide range of experience and knowledge, ensuring that every facet of the sale is managed properly. Via critical preparation, evaluation, and settlement, TAS helps service proprietors accomplish the greatest possible price. By guaranteeing legal and governing conformity and handling due diligence together with other deal employee, deal advisors minimize potential threats and liabilities.

About Transaction Advisory Services

By contrast, Huge 4 TS groups: Work on (e.g., when a prospective buyer is carrying out due persistance, or when a deal is shutting and the customer needs to integrate the business and re-value the vendor's Balance Sheet). Are with charges that are not connected to the bargain closing efficiently. Make charges per interaction someplace in the, which is much less than what financial investment banks earn even on "little offers" (however the collection probability is likewise a lot greater).

The interview inquiries are really comparable to financial investment banking meeting concerns, however they'll focus a lot more on bookkeeping and assessment and less on topics like LBO modeling. As an example, expect questions regarding what the Change in Capital ways, EBIT vs. EBITDA vs. Internet Income, and "accounting professional just" topics like trial equilibriums and exactly how to go through occasions utilizing debits and credit scores as opposed to economic declaration changes.

3 Simple Techniques For Transaction Advisory Services

Specialists in the TS/ FDD teams might also talk to administration concerning everything over, and they'll write a detailed report with their searchings for at the end of the process.

, and the basic form looks like this: The entry-level role, where you do a great deal of data and economic evaluation (2 years for a promotion from below). The following degree up; comparable job, however you obtain the more fascinating bits (3 years for a promo).

Specifically, why not try here it's difficult to obtain advertised beyond the Manager degree because few people leave the job at that stage, and you need to start showing proof of your ability to produce income to advancement. Let's begin with the hours and way of life since those are simpler to define:. There are periodic late evenings and weekend job, however nothing like the frantic nature of financial investment banking.

There are cost-of-living changes, so expect reduced settlement if you're in a less costly location outside major monetary centers. For all settings other than Companion, the base pay makes up the mass of the complete settlement; the year-end incentive could be a max of 30% of your base wage. Often, the very best method to increase your revenues is to switch to a different company and discuss for a greater income and reward

Get This Report on Transaction Advisory Services

At this phase, you should simply remain and make a run for a Partner-level role. If you want to leave, maybe relocate to a customer and do their assessments you can find out more and due persistance in-house.

The primary problem is that due to the fact that: You usually require to join an additional Large 4 team, such as audit, and work there for a few years and afterwards move right into TS, work there for a few years and after that move into IB. And there's still no guarantee of winning this IB role since it relies on your region, clients, and the hiring market at the time.

Longer-term, there is likewise some risk of and since examining a company's historic financial info is not specifically rocket science. Yes, people will constantly require to be entailed, yet with advanced modern technology, reduced head counts might possibly support customer involvements. That claimed, the Transaction Providers group beats audit in regards to pay, work, and leave possibilities.

If you liked this write-up, you may be thinking about reading.

The 9-Second Trick For Transaction Advisory Services

Establish advanced financial frameworks that help in figuring out the real market worth of a firm. Supply advisory job in relation to organization valuation to assist in bargaining and pricing frameworks. Explain the most suitable kind of the deal and the sort of factor to consider to employ (cash, stock, earn out, and others).

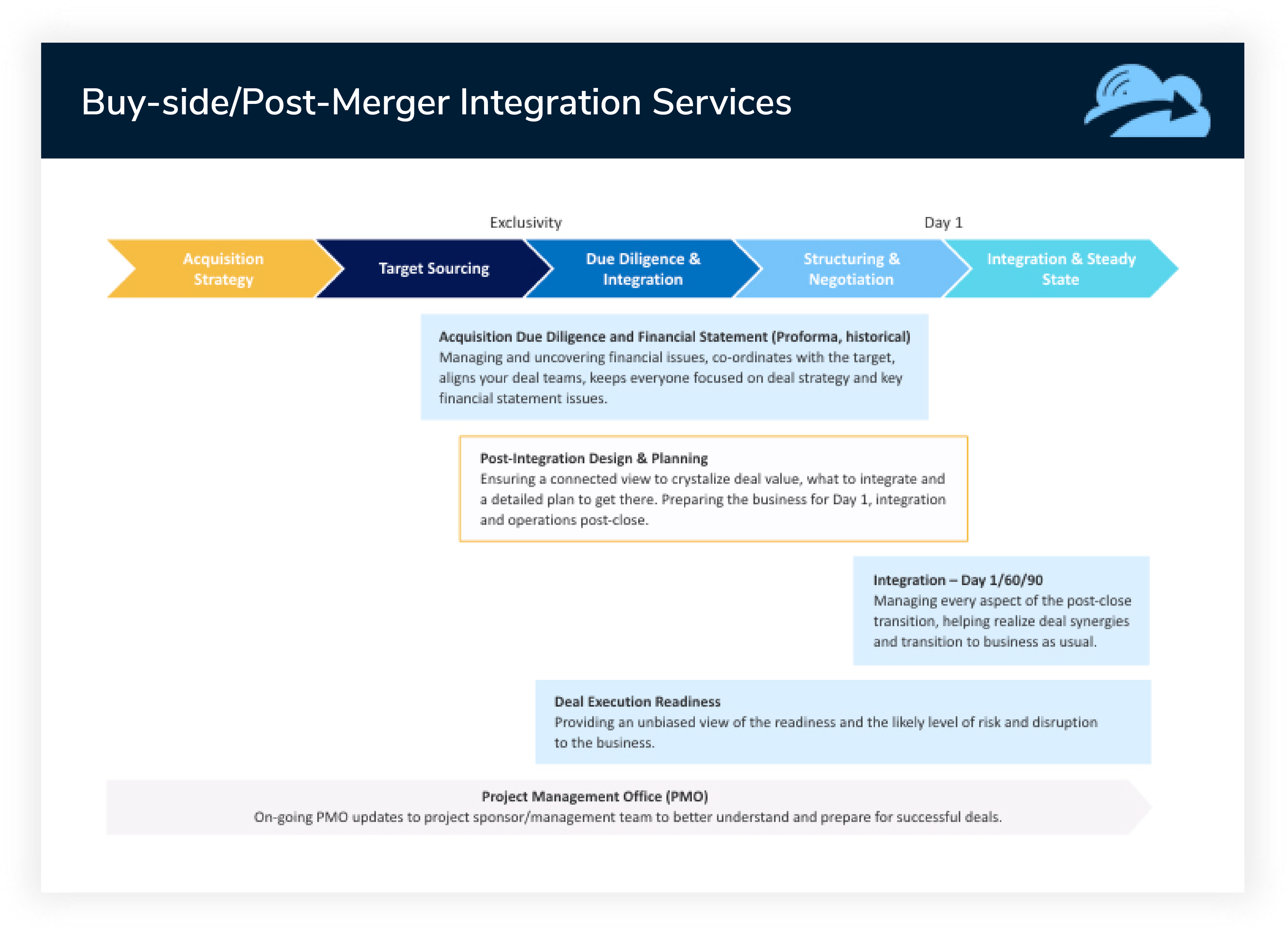

Establish activity strategies for risk and direct exposure that have actually been identified. Do integration preparation to identify the procedure, system, and business changes that might be required after the bargain. Make mathematical quotes of assimilation costs and a fantastic read advantages to evaluate the economic rationale of combination. Establish guidelines for integrating divisions, innovations, and company processes.

Examine the potential consumer base, industry verticals, and sales cycle. The operational due persistance uses crucial understandings into the performance of the company to be acquired worrying threat evaluation and value production.